As a general rule, all countable resources owned by the Institutionalized Spouse are considered available to pay his or her nursing home bills. It does not matter whether the resource is co-owned with someone else unless co-ownership makes it impossible to liquidate the resource. Georgia ABD Manual § 2300 states that resources include cash, other personal property and real property that the applicant or ineligible spouse or parent own under the following conditions:

- The owner has the right, authority, or power to convert the asset to cash (if not already cash).

- The owner is not legally restricted from using the asset for his/her support and maintenance.

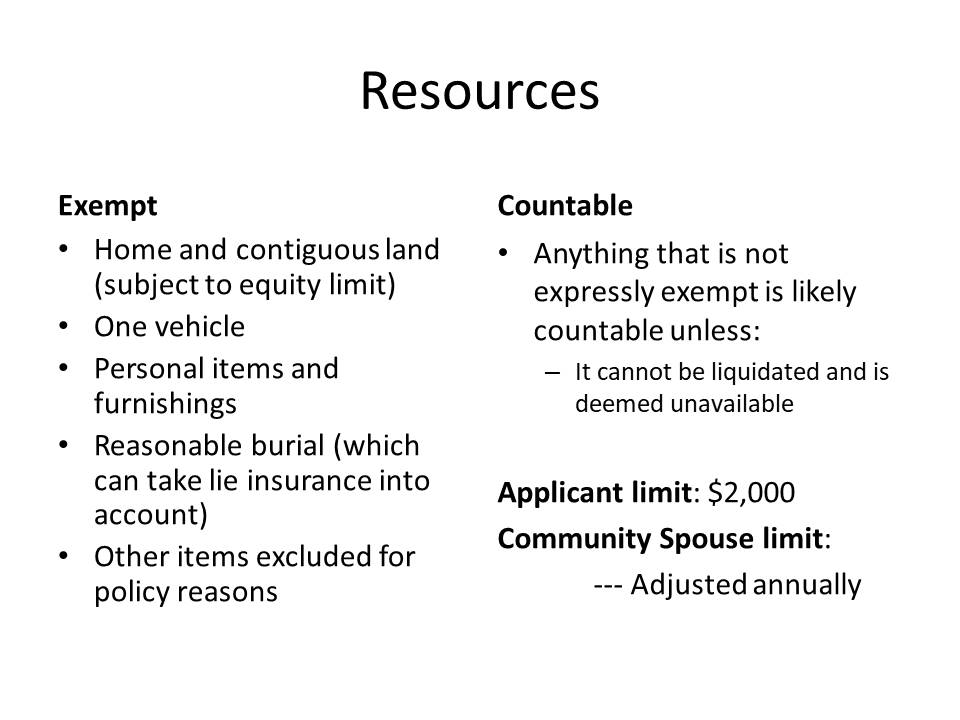

Not all resources count toward eligibility, but the Medicaid recipient cannot have more than $2,000.00 in countable resources. If there is a Community Spouse, then he or she is entitled to an allowance out of the countable resources. The allowance is adjusted each year. In 2023, the maximum resource allowance for a Community Spouse is $148,620. Some States, such as Georgia, allow the Community Spouse to keep the maximum allowance. Other States, such as Tennessee, allow the Community Spouse to keep one-half of the marital estate between the minimum resource standard and the maximum resource standard. In 2023, the minimum resource standard is $29,724.

In general terms, until an applicant’s countable resources (and any deemor’s resources) fall below the resource limit, he or she is not eligible for Medicaid. Examples of exempt resources include:

- The home and contiguous property;

- Household goods and personal effects;

- One vehicle;

- A burial exclusion (calculated differently in each State);

- Burial plots and burial space items;

- Certain income producing property essential to self-support;

- Unavailable resources; and

- Certain other items excluded for policy reasons.

See 20 C.F.R. 416.1210; see also 42 U.S. Code § 1382b (listing resources exempt under the SSI statute). Of note, the rule relating to income-producing property essential to self-support changed effective May 1, 1990 pursuant to Chief Judge Bulletin CJB 08-04 REV. Effective May 1, 1990, property essential to self-support used in a trade or business is excluded from resources regardless of value or rate of return. See POMS SI 01130.501.A.2. It is also worth noting that 20 C.F.R. 416.1201(a)(1) states “If a property right cannot be liquidated, the property will not be considered a resource of the individual.” Further, 20 C.F.R. 416.1245(b)(1) provides that excess real property is not included in countable resources for so long as the individual’s reasonable efforts to sell it have been unsuccessful.

For the applicant, the resource limit continues to apply after eligibility is established. Different rules, explained below, apply to a Community Spouse because deeming terminates once the Applicant establishes eligibility. For applicants, the resource threshold remains at $2,000 and is reviewed during each annual review or when a change in circumstances is reported. Thus, an infusion of cash (e.g., an inheritance or malpractice recovery) will create an eligibility problem. Therefore, if nursing home resident Mary inherits $50,000 from Paul, Mary must report her change in financial condition within ten days. Medicaid will treat that money as income (in most instances) during the month of receipt; If Mary retains any of that money, then whatever she retains is treated as a resource, subject to the $2,000 limit, on the first day of the following month. Mary would be ineligible for Medicaid if her resources totalled even one cent more than $2,000 beginning on the first day of the month after receipt.