Government Bonds are debt instruments issued by a government entity. The most common form of government bond owned by a Medicaid applicantis U.S. Savings Bonds. Savings bonds are not transferrable. They can only be sold back to the government.

If they are owned solely by the applicant or the applicant’s spouse, they are countable. However, if there is a co-owner who refuses to sell, then the savings bonds are unavailable. Unfortunately, purchasing bonds jointly is the only way to make bonds unavailable as long as the Treasury waives restrictions on how long these bonds must be held. Having said that, consider the following hypothetical” Mom and child each have $$50,000. They jointly contribute their funds toward the purchase of $100,000 in bonds, all owned jointly. Mom receives fair market value, so there is no transfer of resources penalty. If Mom needs nursing home Medicaid and child refuses to sell, then Mom’s $50,000 should be unavailable. The question is whether making this joint purchase would be deemed a reduction or elimination of “control” within the meaning of 42 U.S.C. § 1396p(c)(3). That determination might turn on when the purchase was made and the circumstances, including “intent,” since 42 U.S.C. § 1396p(c)(2)(C) prohibits imposition of a penalty where “(i) the individual intended to dispose of the assets either at fair market value, or for other valuable consideration, (ii) the assets were transferred exclusively for a purpose other than to qualify for medical assistance.”

Paper bonds can be cashed where the owner has an account (assuming the bank will cooperate). Treasury direct suggests that you ask your bank (1) will they cash your savings bonds, (2) how much will they cash at one time; and (3) what identification or other documentation is needed.

You can also cash bonds by completing FS Form 1522 and sending the bonds to the Bureau of the Fiscal Service. The Treasury Direct page indicates you should fill out the form; get your signature certified (if requesting more than $1,000); and send the UNSIGNED bonds and completed form to the address on Form 1522.

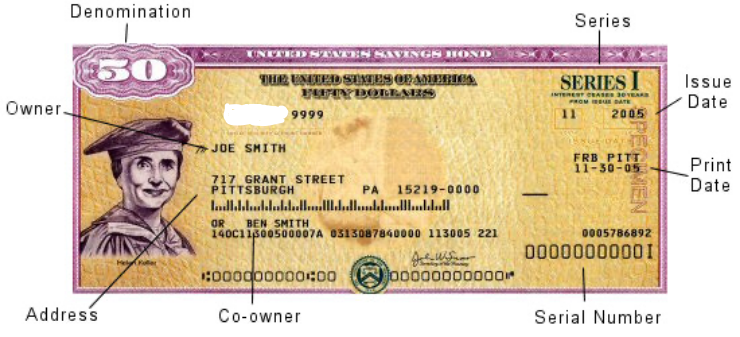

When completing the form, you will need to identify the bonds and the following diagram may help:

Video Wills You might wonder whether you can make a video recording of yourself stating…

2025 Georgia Medicaid Transfer Penalty If an applicant for long-term care Medicaid (e.g., nursing home…

Recently, my dad died. While I was driving back from being sworn in as his…

In Georgia, an individual has legal capacity to make a Will "when the testator has…

Last updated 2/28/2025 The Georgia Power of Attorney Act was enacted in 2017 (HB 221)…

In North Carolina Department of Revenue v. The Kimberley Rice Kaestner 1992 Family Trust, the…