On the income side, there are three pathways to Medicaid eligibility for nursing home residents. First, SSI recipients are almost always eligible. Second, in most States, if the resident’s income does not exceed 300% of the federal poverty level ($2,742 in 2023), then he or she qualifies for Medicaid under a “special income level.” Third, medically needy residents (AMN) who are 65 or older, blind or disabled receive Medicaid. Medically needy residents achieve eligibility by spending down (paying medical bills) until their net monthly income falls below $2,523 (2022). Since the monthly cost of nursing home care almost always exceeds the resident’s income, most nursing home residents either meet the income criteria for Medicaid eligibility or can spend down to meet that criteria.

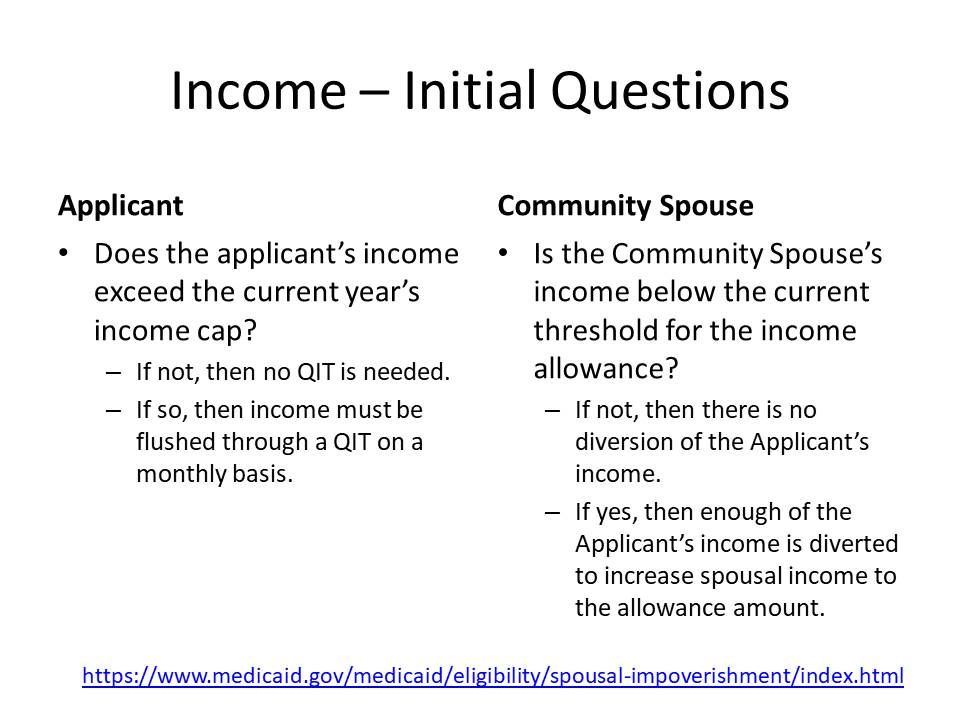

Georgia terminated its AMN program for nursing home residents as of September 1, 2004. Since then, an income cap applies to most long-term care classes of assistance. This includes the nursing home and CCSP (now called the Elderly Disabled Waiver Program) classes of assistance. The income cap is three times the SSI benefit rate, which is adjusted annually. In 2023, the income cap is $2,742 (300% of the SSI benefit rate, which is $914 per month). If the applicant’s income is below the income cap, then there is no income eligibility hurdle. However, if the applicant’s income equals or exceeds the income cap, then a qualified income trust (a/k/a Miller Trust or QIT) is necessary to become income eligible. See 42 U.S.C. § 1396p(d)(4)(B). If there is a community spouse, the community spouse’s income is not relevant for purposes of determining whether a qualified income trust is necessary.

Income includes almost anything received during a particular month unless it is expressly excluded. This means Social Security, pension, retirement, required minimum distributions, annuity payments, payments under promissory notes, and payments from any other source count when determining eligibility. The POMS. which apply in SSI-States such as Georgia and Tennessee, exclude from income certain third-party payments for medical care, personal services, proceeds from the sale of an exempt resource, rebates or refunds, income tax refunds, credit life and credit disability payments (when paid to the lender), proceeds from a loan, payment of bills by a third party (other than food clothing and shelter), and certain non-cash items. However, when shelter and food are provided for an SSI beneficiary (and sometimes a Medicaid beneficiary), in-kind income may be counted. With respect to SSI, in-kind support and maintenance may result in a one-third reduction of the benefit amount paid.

- POMS SI 00810.015 – Types of Income

- POMS SI 00810.020 – Forms and Amounts of Income

- POMS SI 00810.030 – When Income is Counted

- POMS SI 000810.310 – Procedure for Computing Countable Income

- POMS SI 00815.001 – What is Not Income

- Georgia ABD Manual § 2499 – Treatment of Income in Medicaid Chart

Medicaid is a cost-share program with respect to income. That means that unless a permissible diversion applies, nursing home residents pay substantially all of their monthly income toward the cost of care before Medicaid pays the balance of the nursing home expense. (Click here for charts showing how income is used).