Elle’s Safe Place

Medicaid Income Eligibility

A Medicaid applicant’s monthly income must be used the way Medicaid says it must be used. If there is a healthier spouse (a “Community Spouse”), then the Community Spouse can use his or her income in any manner, and the Community Spouse’s income is fully protected. It can, however, become at risk if it is saved because saved income becomes a resource on the first day of the month after receipt and is then subject to the resource rules.

First, “[a]ll money, earned or unearned, received from any source is considered in determining financial eligibility and benefit level.” Second, income is considered on a monthly basis and is only treated as income during the month of receipt. GA ABD Manual 2401. Saved income becomes a resource on the first moment of the following month. That is why monthly income usually has no impact on the $2,000 resource limit. Each month, as income comes in, it also goes out to pay bills. ”

Medicaid is a cost-share program, so usually you must contribute your income toward the payment of your medical expenses before Medicaid pays the balance of the bill. This is known as a cost-share, and is sometimes referred to by other names, such as the patient liability amount. If there is a cost-share, it must be paid to the nursing home each month or the resident will be discharged for non-payment. Remember, unless the permitted deductions result in a zero cost share, Medicaid does not pay the total bill. That is why invoices from the nursing home must be paid. If you think the cost share calculation is incorrect, then call your elder law attorney.

Medicaid imposes an income limit on the Institutionalized Spouse. The income limit is generally three times (3x) the rate paid to Supplemental Security Income beneficiaries. In 2022, the Medicaid income cap is $2,543. See Spousal Impoverishment at Medicaid.gov for the most recent numbers.

The applicant’s income is generally used in one of four ways as follows: (i) payment of the Medicaid recipient’s $70 personal needs allowance; (ii) payment of an income diversion to a low-income spouse or permitted dependent; (iii) payment of approved health care expenses not covered by Medicaid; and (iv) payment of the Medicaid recipient’s cost-share.

If the applicant’s monthly GROSS income is greater than the income cap (even by one penny), then you cannot become income eligible unless you use a Qualified Income Trust. If your monthly GROSS income exceeds the income cap and you do not use a Qualified Income Trust, or if you use it the wrong way, then you are NOT eligible for Medicaid.

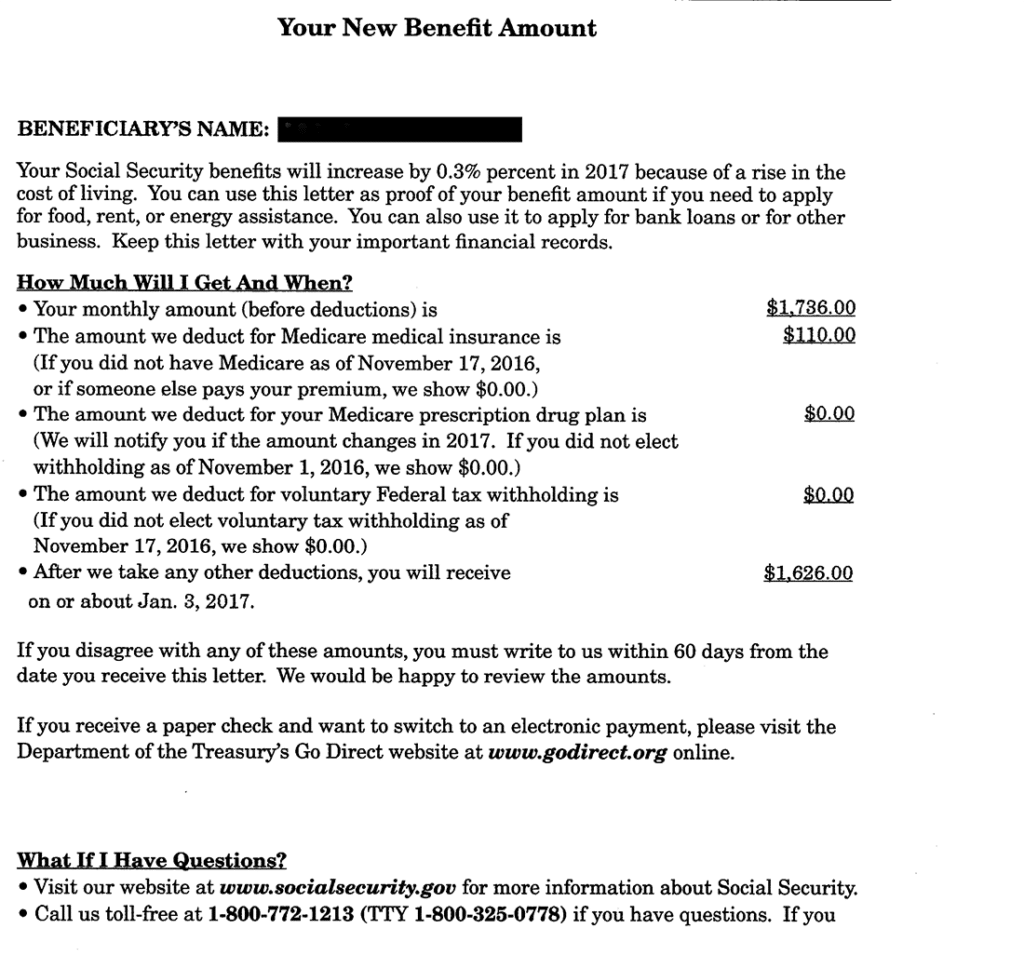

You must report ALL income to Medicaid and you must report gross income. Medicaid uses gross income to determine whether a qualified trust is needed, so bank statements, which only show net income after deductions, will not be accepted. Also, Medicaid wants this year’s income, not last year’s income, so tax records are not what Medicaid needs. An example of the Social Security income letter Medicaid wants to see (the COLA letter issued in December of each year) is below:

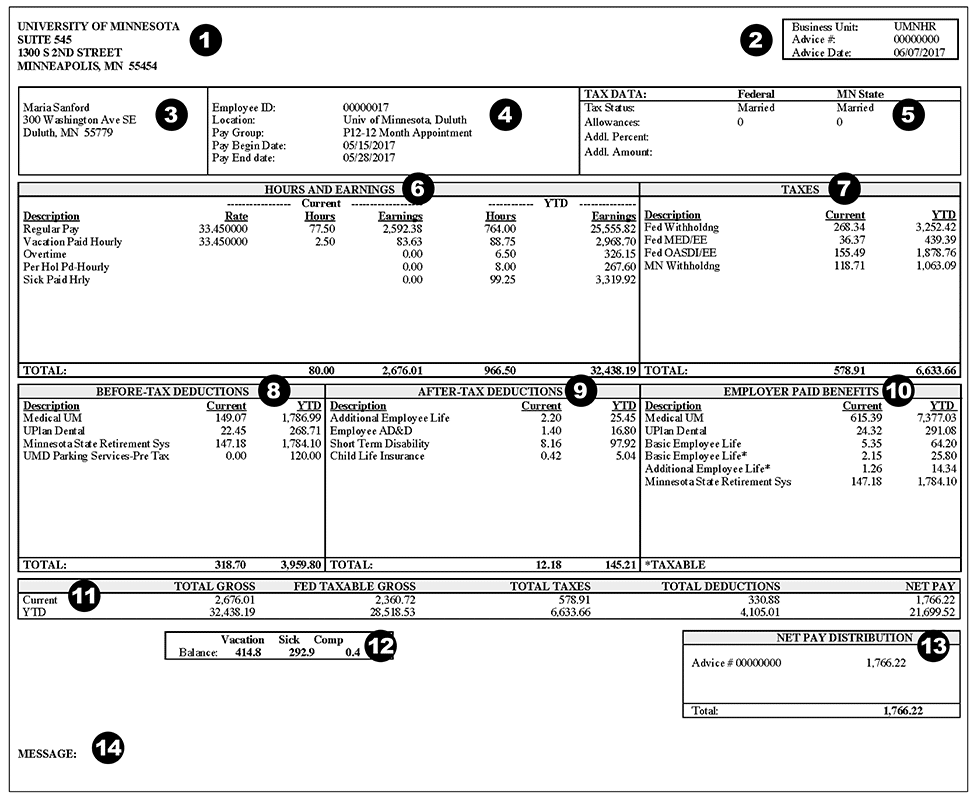

An example of a pay stub showing deductions is below:

The Community Spouse’s Income.

There is no income limit for the Community Spouse (the healthy spouse who is not applying for Medicaid). However, Medicaid will ask about the Community Spouse’s income because a low-income Community Spouse is entitled to an income diversion (meaning some or all of the sick spouse’s income may be paid to or retained by the Community Spouse if he or she has low income). In 2022, a Georgia Community Spouse with less than $3,435.00 of monthly income is considered a low-income spouse. See Spousal Impoverishment at Medicaid.gov for the most recent numbers.

For readers in other States, be wary. Georgia currently allows the Maximum Monthly Maintenance Needs Allowance to be diverted to a low-income Community Spouse. Some States like Tennessee use a different formula permitted under 42 U.S.C. § 1396r-5. That formula allows the State to initially divert the Minimum Monthly Maintenance Needs Allowance, which is $2,177.50 (in 2022). Then, a determination is made concerning whether the Community Spouse needs an additional housing allowance of up to $653.25 (in 2022). (Note, for these states, the Minimum Monthly Maintenance Needs Allowance is adjusted twice each year).

If a Community Spouse’s post-eligibility income falls below the MMMNA, then an additional amount called the Community Spouse Monthly Income Allowance (CSMIA) is deducted from the Institutionalized Spouse’s income and paid to the Community Spouse 42 U.SC. § 1396r-5(d)(1)(B). In cases where the CSMIA is inadequate to raise the Community Spouse’s post-eligibility income to the MMMNA, the CSRA may be administratively raised to generate the income necessary to raise the Community Spouse’s income to the MMMNA. 42 U.SC. § 1396r-5(e)(2)(C). This occurred in Docket No. OSAH-DFCS-NH-0912867-44-Gatto (December 11, 2008).

Another Word About Cost Share

Remember, there are only 6 legal reasons for a nursing home to discharge a resident. See 42 CFR § 483.15(c)(1)(E). One of those reasons is non-payment. If you do not pay your cost-share, then the nursing home bill is not paid in full and it can discharge you.