In the original 1935 Social Security Act, programs were introduced for needy aged and blind individuals and, in 1950, needy disabled individuals were added. These three programs were known as the “adult categories” and were administered by State and local governments with partial Federal funding. In 1969, President Nixon identified a need to reform these and related welfare programs to “bring reason, order, and purpose into a tangle of overlapping programs.” In 1971, Secretary of Health, Education and Welfare, Elliot Richardson, proposed that SSA assume responsibility for the “adult categories.” The result was the creation of the Supplemental Security Income (SSI) program in 1972.

SSI is a “means tested” cash assistance program funded and administered by the Federal Government. The program is authorized by Title XVI (Supplemental Security Income for the Aged, Blind, and Disabled) of the Social Security Act. It is meant to assist needy aged, blind, and disabled individuals, including disabled children. Benefits are paid without regard to work or insurance requirements, and are financed by general revenue funds. Eligibility in the SSI program is limited to residents of the 50 states, the District of Columbia, and the Northern Mariana Islands.

Prior to the establishment of the SSI program by the Social Security Amendments of 1972, benefits for the needy aged, blind, and disabled were provided by the states and territories, with the exception of American Samoa, and financed by federal grants under Titles I, X, XIV, and XVI of the Social Security Act. The 1972 amendments replaced this system of grants with the federal SSI program in the states and District of Columbia only. Residents of the territories were excluded from the SSI program. The territories of Guam, Puerto Rico, and the U.S. Virgin Islands remain eligible for federal grants for aid to the aged, blind, and disabled. Residents of American Samoa are not eligible for SSI or benefits under the aged, blind, and disabled grants. Eligibility for SSI for residents of the Northern Mariana Islands was included in the 1976 covenant that established the Northern Mariana Islands as a United States territory.

To be eligible for SSI, you must meet all eligibility criteria described in 2111–2114 of the Social Security Handbook. No one (except for converted recipients described in 2109 and 2172) can become eligible for SSI benefits without filing an application.

In general terms, an SSI applicant must meet non-financial eligibility criteria and must have monthly income below the monthly SSI benefit rate, and must have less than $2,000 in countable resources. In 2025, the monthly benefit rate for an individual is $967.

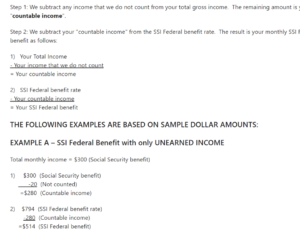

Income is anything you receive during a calendar month and can use to meet your needs for food or shelter. It may be in cash or in kind. In-kind income is not cash; it is shelter, or something you can use to get shelter. Income can be deemed available from someone else such as a spouse or child. However, not all income is countable. Countable income is the amount left over after: (1) Eliminating from consideration all items that are not income; and (2) Applying all appropriate exclusions to the items that are income. Of the several income exclusions that may apply, only one — the student earned income exclusion — has maximum amounts which increase with the cost of living as measured by the COLA. This exclusion applies to a blind or disabled child who is a student regularly attending school, college, or university, or a course of vocational or technical training.

1. The SSI Federal Benefit Rate is $967.00 (in 2025).

2. One-third of the SSI Federal Benefit Rate of $967 is $322.

3. $322 (1/3 of the Federal Benefit Rate)

+$20.00 (from the PMV rule)

————————————————————————

=$342 (the PMV of in-kind support and maintenance)

4. $342 (the PMV of in-kind support and maintenance)

-20.00 (general income exclusion)

————————————————————————

= $322 (the amount of the reduction due to in-kind support and maintenance)

5. $967 (Federal Benefit Rate)

-$322 (reduction due to in-kind support and maintenance)

———————————————————————-

= $645 (your SSI benefit amount)

Resources are money and other possessions that are not monthly income and that may be turned in cash. Not all resources are countable, but those that are countable are subject to a cumulative limit of $2,000. The following resources generally do not count toward the resource limit: (1) the home you live in and the land it is on; (2) one vehicle, if you or a member of your household use it for transportation; (3) household goods and personal effects; (4) life insurance policies you own with a combined face value of $1,500 or less; (5) burial plots or spaces for you or your immediate family; (6) burial funds of up to $1,500 each for you and your spouse’s burial expenses; (7) property you or your spouse use in a trade or business, or on your job if you work for someone else (see the SSI Spotlight on Property Essential to Self Support); (8) if you are disabled or blind, money or property you have set aside under a Plan to Achieve Self-Support (PASS); and (9) Up to $100,000 of funds in an Achieving a Better Life Experience (ABLE) account established through a State ABLE program (see the Spotlight on ABLE Accounts). See Spotlight on Resources. Section 206 of the Foster Care Independence Act of 1999 (P.L. 106-169), which makes the special needs trust rules in Section 1613(e) of the Social Security Act (Act) [42 U.S.C. § 1396p(d)(4)(A) and (C)] applicable to SSI, causes income and/or resources to be exempt if conveyed to the trust prior to the beneficiary attaining the age of 65. POMS SI 01120.203. Virtually everything else that could be converted to cash is countable.

A more thorough analysis would require reviewing the Social Security Handbook, Section 2148 – 2166, the Program Operations Manual System, the Regulations, and ultimately the statute.

Resources: