The eligibility rules for the VA’s needs-based pension programs (commonly referred to as Aid and Attendance) changed effective October 18, 2018. Use of the phrase “Aid and Attendance” is, according to the VA, a misnomer and can be confusing because a higher “aid and attendance rate” may be payable under all of the following VA benefit programs: Pension, parents’ DIC, disability compensation, DIC (for surviving spouses), and death compensation. In addition, a veteran who receives disability compensation may receive additional compensation when the veteran has a spouse and the spousal allowance is higher if the spouse meets aid and attendance criteria.

Under the current rule, a Veteran or surviving spouse is not eligible for Aid & Attendance if he or she has more assets than are allowed under the program rules. Under the VA rules, resources are evaluated under a “corpus of the estate” or “net worth” rule. 38 CFR 3.275. Subsection 3.275(a), assets “means the fair market value of all property that an individual owns, including all real and personal property, unless excluded under paragraph (b) of this section, less the amount of mortgages or other encumbrances specific to the mortgaged or encumbered property. VA will consider the terms of the recorded deed or other evidence of title to be proof of ownership of a particular asset. See also § 3.276(a)(4), which defines “fair market value.””

Asset/Net Worth Limit –

The maximum net worth a VA pension claimant (whether married or single) may have and be eligible for Aid & Attendance from December 1, 2023, to November 30, 2024 is $155,356. This limit is adjusted for inflation each year and is linked to the Medicaid Community Spouse Resource Allowance. See 38 CFR § 3.274(a).

Net Worth Calculation –

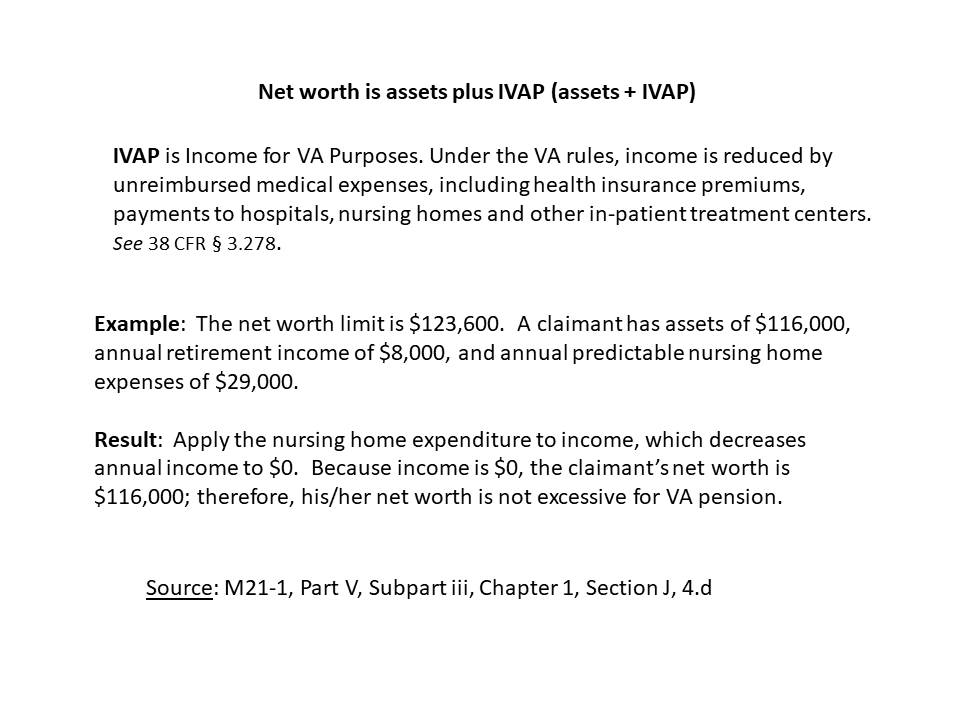

Under the current rule, net worth is the sum of annual income and assets. 38 CFR § 3.274(b)(1). However, some assets are excluded and do not count toward eligibility as provided in § 3.274 and § 3.275. Subsection § 3.274(b)(4) uses the following example to explain how assets and income are combined to determine net worth: “For purposes of this example, presume the net worth limit is $123,600. A claimant’s assets total $117,000 and annual income is $9,000. Therefore, adding the claimant’s annual income to assets produces net worth of $126,000. This amount exceeds the net worth limit.” See also M21-1, Part V, Subpart iii, Chapter 1, Section J – Net Worth, Asset Transfers, and Penalty Periods, Topic 4 (Net worth determinations for Claims Received on or After October 18, 2018) There is no specified income limit since income is included in the resource determination, but not all income is counted.

The following assets are excluded from the calculation pursuant to § 3.275:

(1) Primary residence. The value of a claimant’s primary residence (single-family unit), including the residential lot area, in which the claimant has an ownership interest. VA recognizes one primary residence per claimant. If the residence is sold after pension entitlement is established, any net proceeds from the sale is an asset except to the extent the proceeds are used to purchase another residence within the same calendar year as the year in which the sale occurred.

(2) Personal effects. Value of personal effects suitable to and consistent with a reasonable mode of life, such as appliances and family transportation vehicles. …

(7) Statutory exclusions. Other amounts excluded from assets by statute. See § 3.279. VA will exclude from assets any amount designated by statute as not countable as a resource, regardless of whether or not it is listed in this section or in § 3.279.

Transfers for Less than FMV; grandfathered transactions prior to 10/18/2018 –

If covered assets are transferred for less than fair market value during the look-back period prior to an application for means-tested benefits, then a penalty will be imposed. Section 3.276(a)(3) defines covered asset as the monetary amount (value) by which the asset would cause net worth to exceed the eligibility limit if it was included in the if it was included in net worth. Fair Market Value, defined at § 3.276(a)(4), is used when making this calculation. Subsection 3.276(e) provides that “[w]hen a claimant transfers a covered asset during the look-back period, [the] VA will assess a penalty period not to exceed 5 years. VA will calculate the length of the penalty period by dividing the total covered asset amount by the monthly penalty rate [equal to the maximum annual pension rate (MAPR)] described in paragraph (e)(1) of this section and rounding the quotient down to the nearest whole number. The result is the number of months for which VA will not pay pension.” in 2021, the MAPR for an unmarried veteran is $23,238 or $1,936. The MAPR for a married veteran is $27,549 ($2,295 per month) and the MAPR for a surviving spouse with no dependents is $15,539 ($1,294 per month).

The VA rule is different from the Medicaid Transfer of Resources Rule, and not all transfers cause a penalty. Under the VA rule, only transfers that would cause net worth to exceed the eligibility limit trigger a penalty, and only by the amount those assets would have caused net worth to exceed the eligibility limit. So, if a claimant had $100,000 (which is below the eligibility limit, had no income, and transferred $30,000 there would be no penalty since he or she would be below the $130,773 (in 2021) eligibility limit regardless of whether the transfer occurred. Subsection 3.276(e)(2) states that the penalty period begins on the first day of the month that follows the date of the transfer.

Although there appears to be a typo (since transfers prior to 10/18/2018 are excluded), Subsection 3.276(e)(4) provides the following example of how the penalty is calculated:

VA receives a pension claim in November 2018. The claimant’s net worth is equal to the net worth limit. However, the claimant transferred covered assets totaling $10,000 on August 20, 2018, and September 23, 2018. Therefore, the total covered asset amount is $10,000, and the penalty period begins on October 1, 2018. Assume the MAPR for a veteran in need of aid and attendance with one dependent in effect in November 2018 is $24,000. The monthly penalty rate is $2,000. The penalty period is $10,000/$2,000 per month = 5 months. The fifth month of the penalty period is February 2019. The claimant may be entitled to pension effective February 28, 2019, with a payment date of March 1, 2019, if other entitlement requirements are met.

Look Back Period –

Subsection 3.276(a)(7) states that the look-back period is 36 months. However, it also states that it does not apply to transfers prior to October 18, 2018.

Purchasing Annuities or Creating a Trust to reduce assets –

Special rules apply if a claimant purchased an annuity or made a transfer to a trust. Subsection 3.276(a)(5). However, if assets were transferred to a trust for the sole benefit of a veteran’s disabled child, no penalty is imposed. Subsection 3.276(d).

Curing the Penalty –

Subsection 3.276(e)(5) provides that a transfer does not result in a penalty if the VA receives evidence showing that some or all covered assets were returned to the claimant before the date of claim or within 60 days after the date of VA’s notice to the claimant of VA’s decision concerning the penalty period.